Best for Quickbooks Budgeting Tools: Ultimate Efficiency Guide

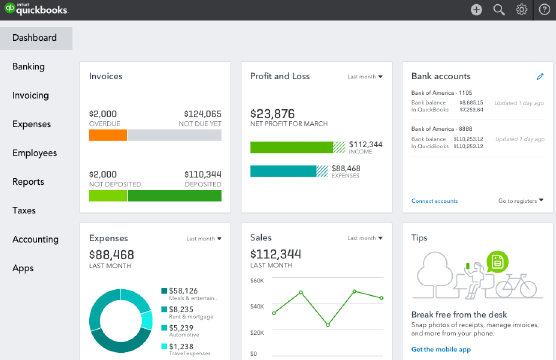

QuickBooks is a great tool for managing money. It is popular. Many people and businesses use QuickBooks. It helps with budgeting, tracking expenses, and more. Let’s look at the best budgeting tools in QuickBooks.

Why Use QuickBooks for Budgeting?

Budgeting is important. It helps you save money. It helps you plan for the future. QuickBooks has many tools to help you. These tools make budgeting easy. They save you time. They make it simple to see where your money goes.

Main Features Of Quickbooks Budgeting Tools

- Track income and expenses

- Create and manage budgets

- Generate financial reports

- Set financial goals

- Monitor cash flow

Creating a Budget in QuickBooks

Creating a budget is easy with QuickBooks. Follow these steps:

- Go to the “Company” menu.

- Select “Planning & Budgeting.”

- Click on “Set Up Budgets.”

- Choose the year for your budget.

- Select the type of budget (profit and loss or balance sheet).

- Enter your budget amounts.

- Save your budget.

Now, you have a budget. You can track your spending. You can see how well you stick to your budget.

Budgeting Tips For Quickbooks

Here are some tips to help you get the most out of QuickBooks:

- Update your budget regularly. Things change. Make sure your budget reflects those changes.

- Compare your budget to actual spending. This helps you see where you can improve.

- Use reports to see trends. Reports show you how your spending changes over time.

- Set realistic goals. Do not set goals that are too hard to reach.

- Review your budget often. This helps you stay on track.

Credit: www.scoro.com

Tracking Expenses with QuickBooks

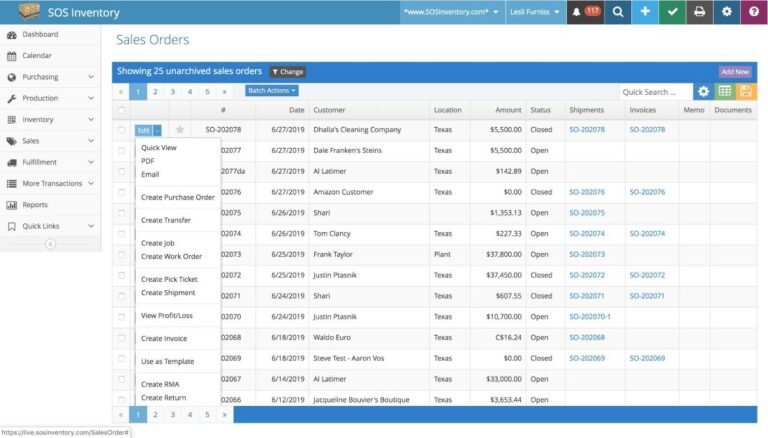

Tracking expenses is important. QuickBooks makes it easy. You can connect your bank accounts. This helps you track spending automatically. You can also enter expenses manually. This way, you do not miss anything.

How To Track Expenses

Follow these steps to track your expenses:

- Go to the “Banking” menu.

- Select “Bank Feeds.”

- Choose “Set Up Bank Feeds for an Account.”

- Follow the steps to connect your bank.

- Review and categorize your transactions.

Now, your expenses are tracked. You can see where your money goes. This helps you stay within your budget.

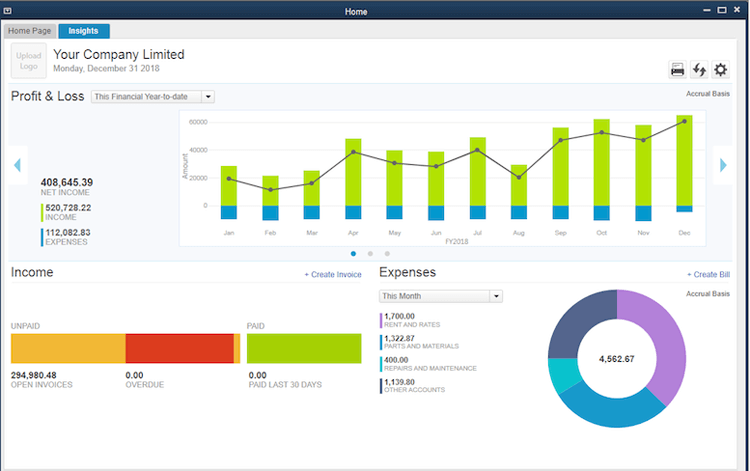

Generating Financial Reports

Reports are helpful. They show you how you are doing. QuickBooks can create many types of reports. These reports help you understand your finances better.

Common Financial Reports

- Profit and loss report

- Balance sheet report

- Cash flow statement

- Budget vs. actual report

How To Generate A Report

Follow these steps to generate a report:

- Go to the “Reports” menu.

- Select the type of report you want.

- Customize the report if needed.

- Click “Run Report.”

Now, you have a report. You can see how you are doing. This helps you make better decisions.

Credit: www.jirav.com

Setting Financial Goals with QuickBooks

Goals are important. They help you stay focused. QuickBooks can help you set and track goals. This makes it easier to reach them.

How To Set Financial Goals

Follow these steps to set goals:

- Go to the “Company” menu.

- Select “Planning & Budgeting.”

- Click on “Set Up Goals.”

- Enter your goal amount.

- Set a target date.

- Save your goal.

Now, you have a goal. You can track your progress. This helps you stay motivated.

Monitoring Cash Flow

Cash flow is important. It shows how much money you have. QuickBooks helps you monitor cash flow. This makes it easier to manage your money.

How To Monitor Cash Flow

Follow these steps to monitor cash flow:

- Go to the “Reports” menu.

- Select “Cash Flow Statement.”

- Customize the report if needed.

- Click “Run Report.”

Now, you can see your cash flow. This helps you make better decisions. You can see if you need to save more. Or if you can spend a little extra.

Frequently Asked Questions

What Are The Best Quickbooks Budgeting Tools?

QuickBooks offers tools like budgeting templates, expense tracking, and financial reporting. These help manage finances effectively.

How To Create A Budget In Quickbooks?

Create a budget by navigating to the “Budgeting” section. Follow the prompts to input your financial data.

Can Quickbooks Track Budget Vs Actuals?

Yes, QuickBooks tracks budget vs actuals. This helps you compare your planned budget with actual spending.

Conclusion

QuickBooks is a great tool for budgeting. It has many features. It helps you track expenses. It helps you create and manage budgets. It helps you generate reports. It helps you set and track goals. It helps you monitor cash flow. These tools make budgeting easy. They help you save time. They help you make better decisions. Try QuickBooks for your budgeting needs. You will see the difference. Happy budgeting!