Best for Quickbooks Tax Preparation: Unlock Maximum Efficiency!

Are you ready for tax season? It can be stressful. But don’t worry! QuickBooks can help you. QuickBooks is a great tool for tax preparation. Let’s learn how to make tax time easy with QuickBooks.

Why Use QuickBooks for Tax Preparation?

QuickBooks helps you keep track of your money. You can record all your business transactions. This makes tax preparation easier. No more searching for receipts. Everything is in one place.

Easy To Use

QuickBooks is simple to use. You do not need to be a finance expert. The software guides you step by step. This makes tax preparation less scary.

Accurate Records

QuickBooks keeps accurate records of your income and expenses. This is very important for taxes. Accurate records mean fewer mistakes. Fewer mistakes mean less stress during tax season.

Saves Time

QuickBooks saves you time. You do not have to do everything by hand. The software does most of the work for you. This gives you more time to focus on your business.

Credit: invedus.com

Getting Started with QuickBooks

Now, let’s get started. Follow these steps to make tax preparation simple.

Set Up Your Quickbooks Account

- Go to the QuickBooks website.

- Create an account.

- Enter your business information.

- Connect your bank accounts.

Setting up your account is easy. Just follow the prompts. QuickBooks will guide you through the process.

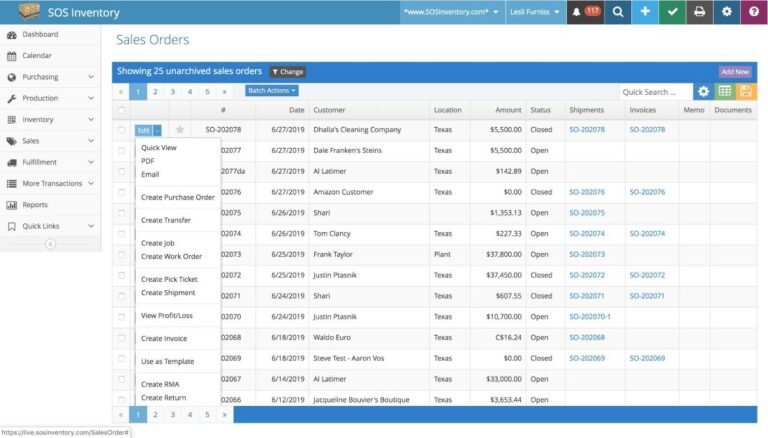

Record Your Transactions

Once your account is set up, start recording your transactions. This includes income and expenses. You can do this manually or connect your bank accounts. If you connect your bank accounts, QuickBooks will automatically import your transactions.

Organize Your Transactions

Organize your transactions into categories. This makes tax preparation easier. You can create custom categories if needed. For example, you can create categories for office supplies, travel expenses, and more.

Preparing for Tax Season

Now that you have recorded and organized your transactions, it’s time to prepare for tax season.

Generate Financial Reports

QuickBooks can generate financial reports for you. These reports are very helpful for tax preparation. The most important reports are:

- Profit and Loss Statement

- Balance Sheet

- Cash Flow Statement

These reports give you a clear picture of your business finances. They show your income, expenses, and profits. This information is important for your tax return.

Review Your Reports

Review your financial reports carefully. Look for any mistakes. Make sure all your transactions are recorded correctly. If you find any errors, fix them before you file your tax return.

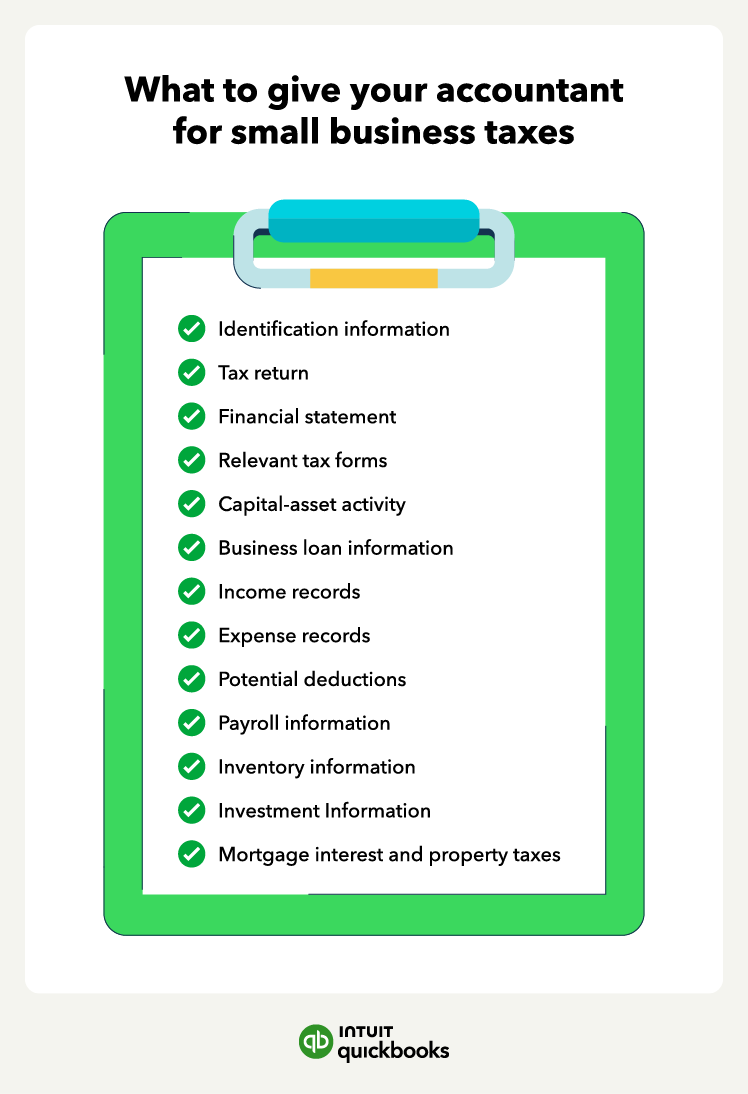

Export Your Data

QuickBooks allows you to export your financial data. You can export your data in various formats. This makes it easy to share with your accountant or tax preparer.

Credit: quickbooks.intuit.com

Filing Your Taxes

Now that you have prepared your financial reports, it’s time to file your taxes.

Use Quickbooks Tax Tools

QuickBooks has built-in tax tools. These tools help you prepare and file your taxes. You can use the QuickBooks tax preparation feature to calculate your tax liability. The software will guide you through the process. This makes filing your taxes less stressful.

Consult A Tax Professional

If you are unsure about anything, consult a tax professional. A tax professional can help you with complex tax issues. They can also review your financial reports and tax return. This ensures that everything is accurate and complete.

Tips for a Smooth Tax Season

Here are some tips to help you have a smooth tax season:

- Keep your records up to date. Record your transactions regularly.

- Organize your receipts and documents. This makes it easier to find them when needed.

- Use QuickBooks to generate financial reports. This gives you a clear picture of your business finances.

- Review your financial reports carefully. Look for any mistakes and fix them.

- Consult a tax professional if needed. They can help you with complex tax issues.

Frequently Asked Questions

How Does Quickbooks Help With Tax Preparation?

QuickBooks tracks income, expenses, and deductions. It simplifies tax filing and ensures accuracy.

Can Quickbooks Handle Complex Tax Situations?

Yes, QuickBooks manages complex tax scenarios. It supports multiple tax forms and schedules.

Is Quickbooks User-friendly For Tax Tasks?

Absolutely! QuickBooks is easy to use. It offers intuitive features for smooth tax preparation.

Conclusion

QuickBooks is a great tool for tax preparation. It helps you keep accurate records. It saves you time. And it makes tax season less stressful. Follow the steps and tips in this guide to make tax preparation easy. Happy tax season!